MPI© (Market Price Indexing) is a holistic approach to market analysis and “time adjustments.”

Here we look at the process, the theory, the judgment, and the benefits of this model.

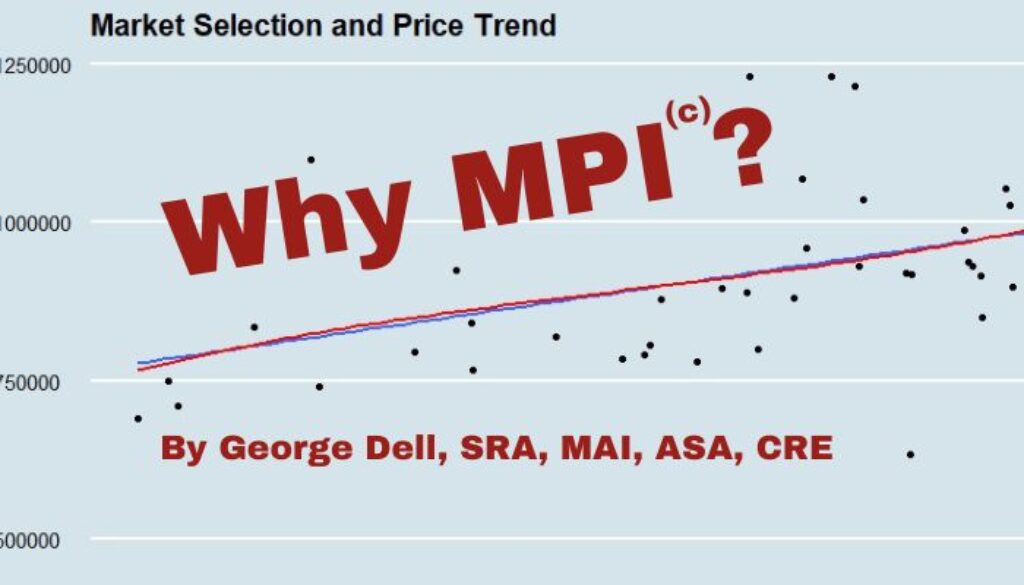

MPI – The process involves simple mechanics:

- Download the relevant competitive market data.

- Create a scatterplot with sale prices over time.

- Clean the data of outliers and influentials.

- Calculate simple linear regression.

The regression coefficient is your exact time adjustment for the exact data applied.

The theory is econometric time-series analysis. It relies on the high auto-correlation within the competitive market data selected. “All ships rise with the tide” in this harbor. (Caution: This model does not work for other “adjustments”).

Expert judgment is clarified, and dramatically sharpened by the objectivity of MPI. (It is market-data oriented, not ‘trust me’ oriented!)

Benefits of MPI are substantial:

- It meets the specific requirement of relevancy (property type and market area), as expressed in The Appraisal of Real Estate, as well as USPAP SR1-4 (all information necessary, and as are available).

- It greatly improves accuracy and precision of the analytic result.

- It enables reliable inclusion of excellent but dated comparables.

- It provides easy compliance with market analysis requirements.

- It allows other data-analysis tools and reproducibility

- Visual presentation empowers greater understanding by users.

Appraisal standards and accepted practices require a market analysis in every appraisal. This includes markets going up, down, slightly up or down, or just level. There is no easy justification for avoiding market trend analysis. The “Scope of Work” rule calls this avoidance “not acceptable.”

To assume a market is “level” (without an analysis) constitutes an extraordinary assumption. Objectively, the exclusion of market trend analysis can constitute “gross negligence.”

It is just as easy to calculate a level (zero change) market, than it is to calculate an up or down trend. Either way it takes only an instant to get the regression coefficient. (Even if a zero trend may never really exist!)

While our residential GSEs require (on paper) time adjustments, there seems to be no real enforcement through lenders to have appraisers apply this simple market conditions model (MPI).

This one change – a regulatory requirement that price indexing be applied in every appraisal – would significantly improve appraisal accuracy, precision, and understandability (and “credibility”). MPI immediately improves other adjustments and the understandability of the market conditions.

Education and training of appraisers is readily available. Software is either already in the hands of appraisers, or readily available as format open-source.

MPI©

uses the right data, employs reproducible results, and is graph-visually appealing.

The © copyright is to protect the model algorithm from those who would monetize and/or misuse.