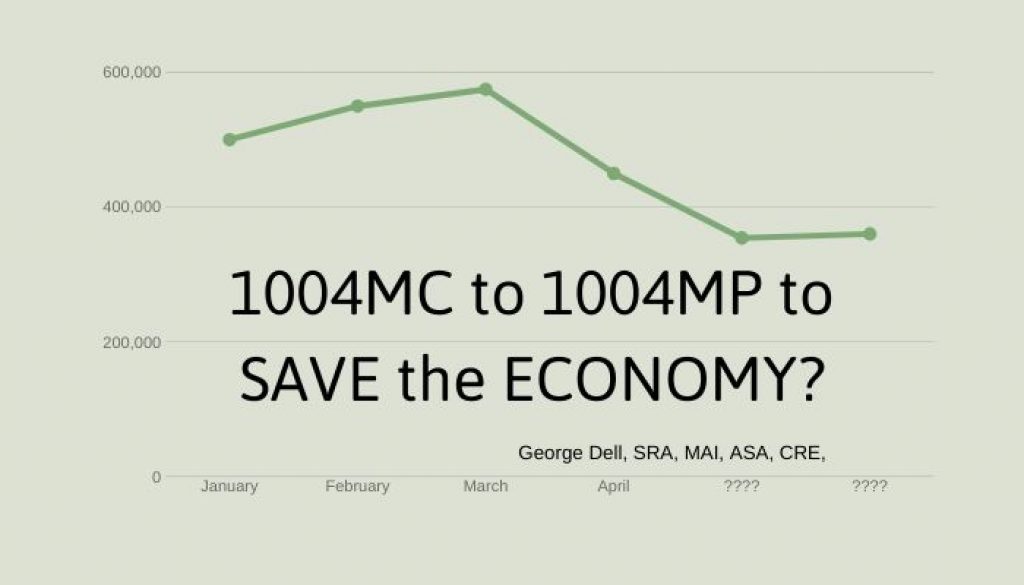

The 1004MC form failed on every important principle of modern science of data analysis. Can we avoid yet another complex, ambiguous monster? What are the simple principles?

Data science is new. It replaces much of the old “take a sample” statistics. And we learned this “inferential sample statistics” from professors who learned it in the last century. (When there was no such science of data.)

Data science recognizes three things: 1) today there’s lots of data; 2) it’s all digital; 3) it takes a field-related expert to make good sense of it.

Data science also recognizes that the human brain cannot directly make sense of a list or a table of data more than six or eight deep. So, it takes advantage of that digital computer power. It:

- Runs algorithms infallibly in an instant (at the expert’s direction).

- Requires a human expert to tell it what algorithms to run.

- Builds visuals, and understandable summaries (numbers, categories, sequences, or names).

So, how can this fit our clients’ needs? What do users need and want? Well – they really want to know if their collateral is safe, or will yield a profit, or if the result is fair. Market price does not measure safety, or profit, or fairness. These three things are measured by risk – “how sure are we?” Worse yet, safety and yield are really predictions of the future.

Legacy appraisal practices do not address safety, yield, or even fairness. Even worse yet, market value may or may not equal market price. (Think “great recession”.)

Data science can help. First, forecasting is not fortune telling. Second, income property appraisers do forecasting all the time. It is called “DCF – discounted cash flow.” Hmmm . . . Yes, Dorothy, that’s what they do. Just don’t look behind the curtain.

Also, economists do it all the time. Hmmm . . . Some look behind the curtain, some don’t. The ones who look behind the curtain see three macroeconomic gauges. Coincident and lagging indicators match or confirm conditions. Leading indicators tend to, well, lead — and make good predictors. Examples include: new jobless claims, money supply, new construction, home sales, and the consumer confidence index. There are many others.

This is important – these indicators are all national, international, or – at best – regional in scope. None of them are at the neighborhood or market-segment level. The domain of micro-economics. So, who has the data and the analytics? The micro-market experience is not the world of economists, or accountants, or forms-software programmers.

This is important – leading market microeconomic indicators can easily be modeled and calculated by appraisers. No new software is needed. In most areas, the data is fully available, especially for residential properties. Appraisers are best positioned to provide the market needs of the near future. (Including COVID-19 pandemic impacts on the macro and micro markets.)

The 1004MP© (Market Pointer) can actually do what the 1004MC was imagined to do. And much more. It concisely defines the relevant data set, shows it visually, and calculates a validated time adjustment. It is needed – profoundly needed – in this time of economic uncertainty.

The need is now for transparent and reproducible valuation, micro-forecasting, and other risk-score measures. The tool is here. It is called Market Price Indexing (MPI©). It is simple and concise. It provides:

- Clear CMS (Competitive Market Segment©) delineation;

- Intuitive and visual validation of the trend;

- Integration with forecast indicators;

- A calculated time adjustment.

We petition one of the GSEs or (FHFA, HUD, VA, or FCA) or even one of the larger mortgage originators to take the lead – to put into effect this simple, powerful, and informative valuation/risk model.

The time is now. The model is primed. The curriculum is done (Stats, Graphs, and Data Science1). Trained/trainable appraisers are ready. Online training is ready in two to four weeks. Needed software is free or already owned.

Who will take the lead?

George Dell, SRA, MAI, ASA, CRE, CDEI, AQB Certified USPAP Instructor, member AVM standards committee. Author of Stats, Graphs, and Data Science.