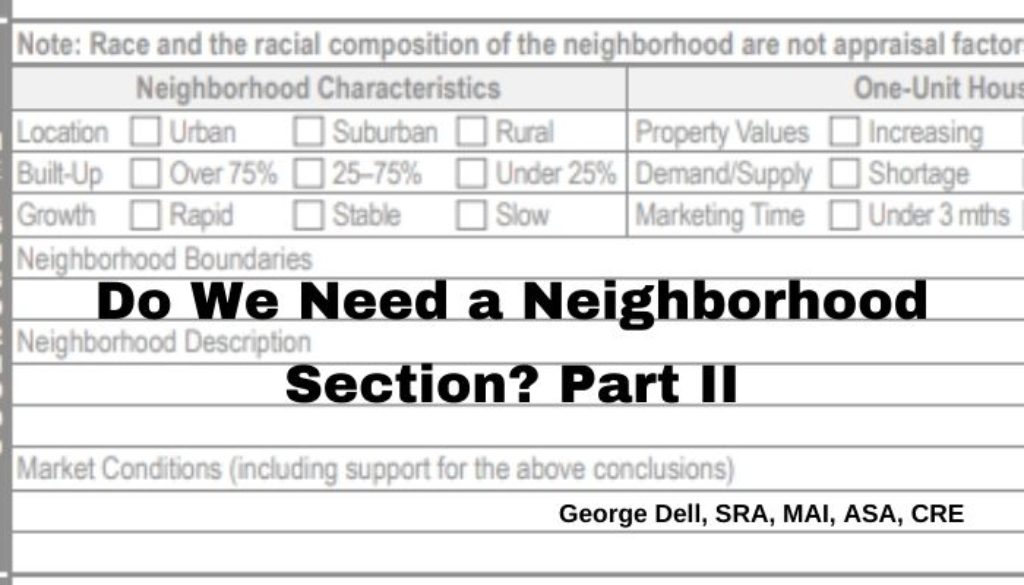

The current residential form (the URAR) neighborhood section is well designed – for data the way it was 40 years ago, filled in on a typewriter, with no software ability to summarize, graph, or map data.

Do We Need a Neighborhood Section? Part I is here.

As complete market data was rarely available, (and difficult to compile statistically), it was difficult to analyze and certainly present in visuals: graphs, maps, and summary numbers. Neighborhood formed a reasonable partition of data from useful to not-so-useful. If it was necessary to go outside a neighborhood, this was considered an exception, with “paired” location adjustments being the only suggested method to adjust. This was gross, unreliable, but at least theoretically accepted.

The neighborhood section today is mostly conclusionary, rather than analytic. The appraiser concludes as to whether characteristics of neighborhood location are urban/suburban/rural; “Built-Up 25%, over 75%, or in between; and Growth is rapid/stable/slow.

Neighborhood Property values not the CMS© (Competitive Market Segment), are up/down/level. Effectively the wrong data set is coarsely concluded, subjectively opined. Not helpful for real analysis.

Demand/Supply is shortage/balanced/oversupplied; again coarse, and subjectively opined.

Marketing Time is under 3 months, over 6 months, or in between. Again, the wrong measure is judged. (It should be exposure time, measurable from actual data.) Again, coarse and subjectively opined.

Prices require low/high/pred (predominant). There is no clarity of the time period to measure. “predominant” is a colloquial word, avoiding logical meaning. (It is not the mean, the median, or the mode.) It is a weasel word – necessary to justify subjective judgment opinion, not analytical measure. In addition, the use of low and high prices, exacerbates outliers and typographical issues. Extremes are seldom a good representation (or analysis) of the distribution of a market segment (or neighborhood).

Neighborhood boundaries are needed for the above measures – if the neighborhood is what you really want to analyze. (See a coming part on the need for neighborhood description and opinions.) Neighborhood description is again subjective narrative. Generally pre-prepared boilerplate sufficed for each neighborhood. No guidance appears ready to connect neighborhood boundaries and neighborhood descriptions to the act of calculating, estimating, or opining on market price.

“Market conditions (including support for the above conclusions).” This line sums up the intermixing of neighborhood boundaries, description, and market conditions. This intermixing may be a detriment to complete analysis for valuation and risk estimation.

Description, or characterization of any data set is a necessary start to solve a problem. The data set must be the relevant, applicable set of information. Analysis can include data selection, as well as prediction from that data. Valuation requires both. Data characterization means classifying or measuring variables. Predictive analysis means counting, associating, or arranging variables.

For future valuation/risk work we need to consider three fundamental issues, and a suggestion:

- Neighborhood is not a definer of market area relevance. Competitive sales may come from both within or without a neighborhood.

- Market analysis is not neighborhood analysis. Market analysis is defined by the five predictive dimensions of the market segment, not just a geographic area.

- Trend analysis (time adjustments) must focus on the CMS© (Competitive Market Segment). Any time adjustment from any another data set creates analytic/model bias.

- Integrated Market Price Indexing (MPI)©, using modern data science concepts simplifies and comprehensively resolves the relevant issues.

©As per Valuemetrics.info (George Dell) curriculum. CMS© is rigorously defined. The copyright is to prevent commercial misuse.

April 27, 2022 @ 5:10 am

Thanks, George, for broaching the subject. I always enjoy your commentary..I’ve always likened market analysis to golf. A ball in the fairway is very different from a ball hit in the rough. It may be the same ball but different shots. Our problem is that we don’t make the report formats, the, clients/lenders/users make the forms and dictate how they are to be used. We can add addenda and comments, but they are seldom read and understood.

Your comments on predominant value are spot on. Maybe the mode value would be better but there may be more than one mode is a data set.

April 28, 2022 @ 2:32 am

I agree with Mark H.. silly that feedback & opinions aren’t ever really asked of real Appraisers when designing forms, right! But I guess “form filling monkeys” only need to know where to put the mark on the page? lol

It’s good for people like George to comment on these subjects, except not so sure I agree with all of George’s takes. But I know this much, is an embarrassing number of licensee’s don’t even understand the basics behind what to include in a neighborhood description.. or that the data they’re pulling from MLS has little to no relation to the neighborhood they described on form page 1 (30+ years ago when I began, I started off basing my neighborhoods around the MLS areas boundaries- seemed like a simple decision for consistency, pulling data, market perception, etc). Maybe one of the things why I say I don’t always agree with George, is if licensee’s are already a little disconnected, then I’m concerned pressing the next level of form being to technical & data driven will only serve to further disconnect licensee’s from being able to connect the dots for “real world” appraising, analytics, and their final value & market opinions.

It doesn’t have to be difficult or complicated, but I think licensees often aren’t used to effortlessly “thinking deep enough” as it is and is why their opinions often don’t match with how they got to their final opinions. And anyone reading Georges articles, gets you thinking more. lol

June 2, 2023 @ 3:00 am

George,

On-point as usual! It is a shame the proprietary real estate appraisal schools do not teach analytics, but maybe it is that the analytics the GSEs want are, in at least one instance, a logical impossibility. For example, by definition, marketing time is a futurity. How, from the historical record, can appraisers reliably and reproducibly peek into the future to predict marketing time? Further, why have appraisers chosen to accept responsibility for this informational conundrum when what acceptance does nothing but give the GSEs another opportunity to throw us under the bus? When appraisers choose to learn the scientific method of enquiry, and then apply it, we will become a profession. When will we so choose?