Price indexing is a result of a good market analysis. What is it, and how can it help?

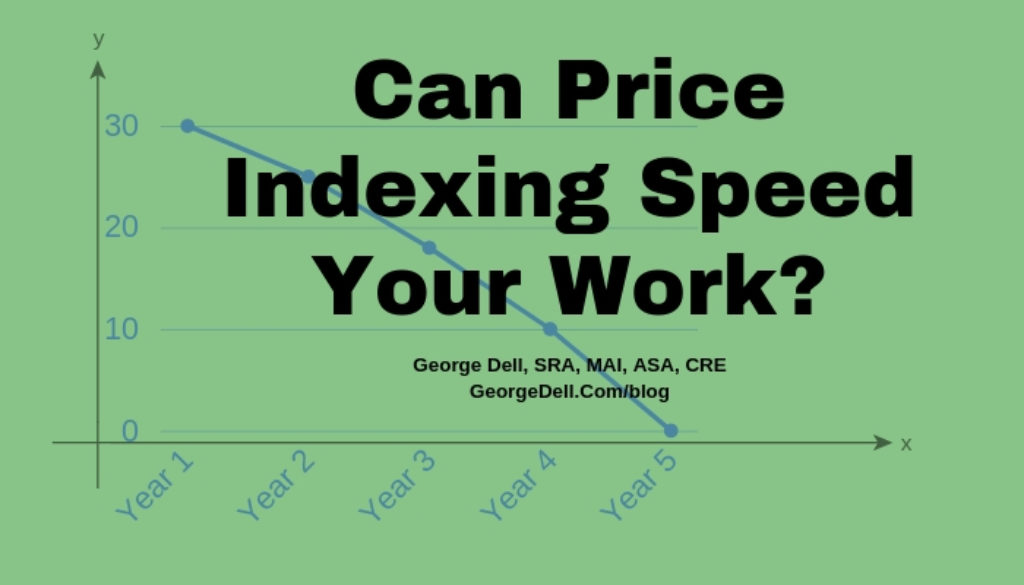

Price indexing solves many of the problems that the 1004mc was intended to do. It is not difficult to do. The result looks something like this:

If you do this using the recommended specific procedure, you will have:

- Compliance with USPAP Rule 1-4, which requires analysis of all available information

- A complete delineation of the CMS (Competitive Market Segment)©

- A clear visual market trend model to paste into your report

- Validation of the appropriate regression line

- Identification of the best comparable data

- A simple to apply time adjustment

The price-index model, once learned, takes only seconds to create. It is applicable to any property type. For residential and non-residential properties, it cleanly shows and presents market analysis for existing properties.

For residential assignments, it can eliminate requests for ‘additional’ information. In particular it accomplishes what the 1004mc purported to do, but is technically correct and model sound. For income and other amenity properties, any unit of measure can be calculated in this manner.

This example demonstrates the clear difference between the data science concept and the old way of doing appraisals. The old way was created for sparse data, where collecting the data was the greater challenge, and good judgment was all we had to support our opinion. The new way is based on complete data, objectively selected, based on the market data itself, not naked judgment.

The new way does apply judgment. However, that judgment is refined to apply new technologies and augmented decision-making.

Today, appraiser judgment is easily enhanced and validated by using market extracted information. In other words, see what buyers are actually doing— based on the data itself, not on what the appraiser thinks is happening.

The appraiser trained in modern data science tools, methods, and models can produce a far superior product. Faster, better, with greater value-added. So yes, proper price-indexing is fundamental to Evidence Based Valuation© practice. It is faster, complete, more accurate and understandable.

The coming edition of our paid subscription to The Asset Analyst Report© (TAAR) will include deeper and more detailed instructions for the principles of price indexing.

The above plot was created in Gnumeric spreadsheet, an open-source program.

April 17, 2019 @ 4:04 am

Good stuff, thank you!

April 17, 2019 @ 8:30 am

I prepare and include at least one of these in every report I do. Thank you, George, for opening my eyes to Data Science.

April 17, 2019 @ 12:40 pm

It’s a great tool for the toolbox. Looking forward to SGDS 2.